EquityMultiple is a real estate investment platform. It offers individual investors access to commercial real estate deals. The platform allows people to invest in real estate without buying physical properties. This review will cover various aspects of EquityMultiple in 2024. We’ll look at its features, benefits, fees, investment options, and user experience. We’ll also discuss the pros and cons, as well as comparisons with other platforms.

Get started with EquityMultiple today

EquityMultiple features

| Feature | Details |

|---|---|

| Minimum investment | $5,000 |

| Account fees | Common equity investments: 0.5-1.5% annually, plus 10% of all profits upon exit |

| Time commitment | 12 Months |

| Accreditation required | ✅ |

| Private REIT | ❌ |

| Offering types | Debt, equity, preferred equity |

| Property types | Commercial |

| Regions served | 50 states |

| Secondary market | ✅ |

| Self-directed IRA | ✅ |

| 1031 exchange | ✅ |

| Pre-vetted | ✅ |

| Pre-funded | ❌ |

What is EquityMultiple?

EquityMultiple is an online platform. It connects investors with real estate opportunities. It was founded in 2015. The goal was to democratize real estate investing. EquityMultiple partners with experienced real estate companies. They offer a variety of deals. These include equity investments, preferred equity, and debt investments. Investors can diversify their portfolios with these options.

Get started with EquityMultiple today

How EquityMultiple works

To start, investors need to sign up on the EquityMultiple website. The process is straightforward. Investors must provide some personal information. They also need to verify their accredited investor status. This means they must meet certain income or net worth requirements.

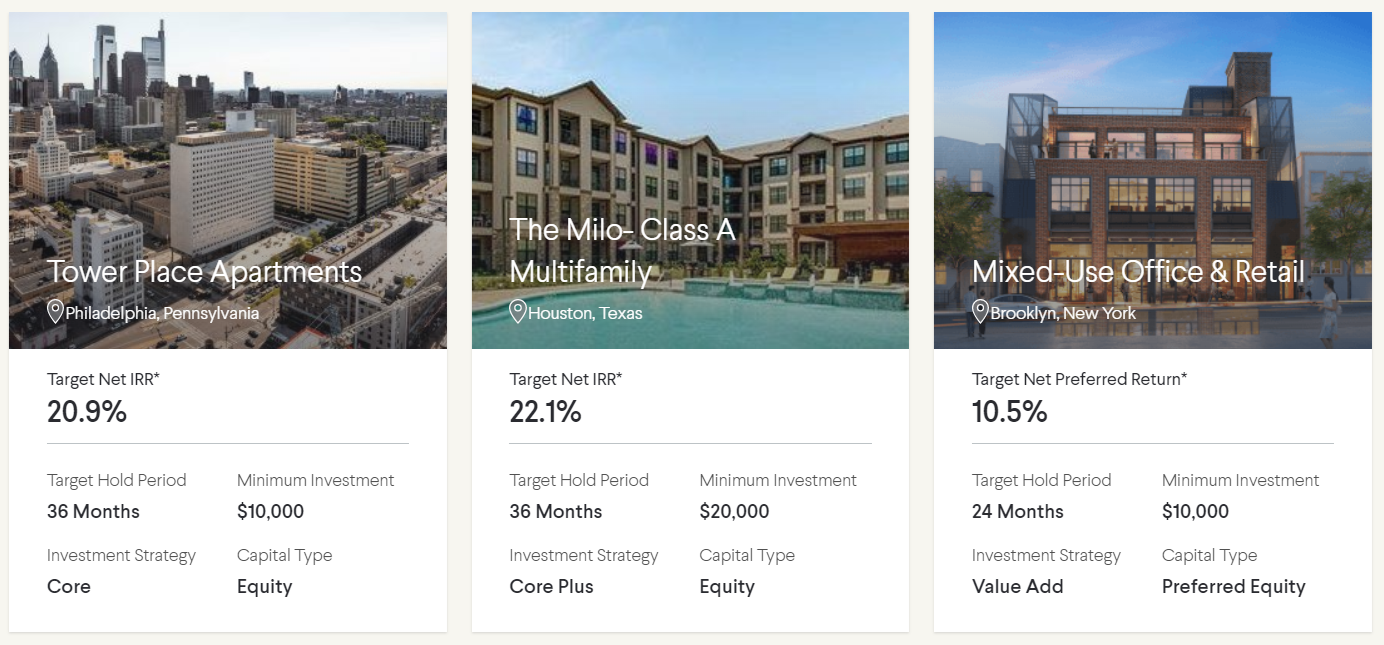

Once verified, investors can browse available deals. Each deal comes with detailed information. This includes the property type, location, investment strategy, projected returns, and risks. Investors can then choose which deals to invest in.

Getting started with EquityMultiple

One of the big benefits of crowdfunding platforms is the ease and convenience of investing and managing your investments online. With EquityMultiple, the entire process takes place on the online platform. It works like this:

1. Register for the platform.

2. Browse live offerings.

3. Review investment details and choose a deal that fits your investment objectives.

4. Complete your account setup and link your bank account to fund investment choices and receive distributions.

5. Complete the investment “checkout” process: E-sign documents, verify your accreditation and fund your investment.

Once you’ve invested, you can:

- Monitor your investment performance on the “My Portfolio” page.

- Receive regular asset management on all your investments through the “My Activity” feed.

- Receive earnings directly through ACH bank transfer.

- View quarterly investor updates on asset performance.

Types of Investments

EquityMultiple offers three main types of investments:

- Equity Investments: Investors buy a share of the property. They earn returns from property appreciation and rental income.

- Preferred Equity: Investors have a higher claim on the property’s cash flow than common equity investors. They receive fixed returns before common equity investors.

- Debt Investments: Investors lend money to property developers or owners. They earn fixed interest payments. These investments are typically less risky than equity investments.

Investment Opportunities

EquityMultiple provides a variety of real estate opportunities. These include:

- Commercial Properties: Office buildings, retail centers, and industrial properties.

- Residential Properties: Apartment complexes and multifamily units.

- Mixed-Use Properties: Buildings with both commercial and residential spaces.

- Development Projects: New construction or significant property renovations.

Returns and Performance

EquityMultiple aims to provide attractive returns to investors. The returns depend on the type of investment and the performance of the property. Equity investments can offer high returns but come with higher risks. Preferred equity and debt investments offer more stable returns with lower risk.

Fees and Costs

EquityMultiple charges various fees. These include:

- Origination Fees: Typically 1% to 3% of the total investment amount. This fee covers the costs of sourcing and vetting deals.

- Asset Management Fees: Usually around 1% to 2% of the invested amount per year. This fee covers the costs of managing the investment.

- Servicing Fees: For debt investments, there may be a small fee for managing the loan.

Investors should carefully review the fee structure for each deal. Fees can impact overall returns.

User Experience

EquityMultiple’s platform is user-friendly. The website is well-designed and easy to navigate. Investors can quickly find information about deals. The platform also offers educational resources. These help investors understand real estate investing better.

Customer Support

EquityMultiple provides good customer support. Investors can contact the support team via phone, email, or live chat. The support team is knowledgeable and responsive. They can help with any questions or issues investors may have.

Pros of EquityMultiple

- Access to Commercial Real Estate: Investors can access high-quality real estate deals.

- Diverse Investment Options: The platform offers equity, preferred equity, and debt investments.

- User-Friendly Platform: The website is easy to use, with detailed information on each deal.

- Good Customer Support: The support team is helpful and responsive.

- Educational Resources: The platform offers resources to help investors learn about real estate investing.

Cons of EquityMultiple

- Accredited Investors Only: Only accredited investors can invest on the platform.

- Fees: The various fees can impact overall returns.

- Risk: Real estate investments come with risks, and returns are not guaranteed.

Comparisons with Other Platforms

There are several other real estate investment platforms. Here’s how EquityMultiple compares:

- Fundrise: Fundrise is open to non-accredited investors. It offers a lower minimum investment. However, it focuses more on residential properties.

- RealtyMogul: RealtyMogul offers both commercial and residential deals. It also requires accredited investor status for certain investments.

- CrowdStreet: CrowdStreet focuses on commercial real estate. It has a higher minimum investment but offers a wide variety of deals.

Conclusion

EquityMultiple is a solid option for accredited investors. It offers access to high-quality commercial real estate deals. The platform is user-friendly, and the support team is helpful. However, investors should be aware of the fees and risks involved. Overall, EquityMultiple can be a valuable addition to a diversified investment portfolio.

Frequently Asked Questions (FAQs)

1. Who can invest with EquityMultiple? Only accredited investors can invest with EquityMultiple. This means they must meet certain income or net worth requirements.

2. What types of investments does EquityMultiple offer? EquityMultiple offers equity investments, preferred equity, and debt investments.

3. What is the minimum investment amount? The minimum investment amount varies by deal but typically starts at $5,000.

4. How does EquityMultiple make money? EquityMultiple makes money through origination fees, asset management fees, and servicing fees.

5. Are there risks involved? Yes, all real estate investments come with risks. It’s important to review each deal carefully and understand the potential risks.

6. Can I sell my investment? Real estate investments on EquityMultiple are typically long-term. It may not be easy to sell your investment before the project is completed.

Final Thoughts

EquityMultiple provides a valuable opportunity for accredited investors to diversify their portfolios. The platform’s focus on commercial real estate offers potential for high returns. While there are fees and risks involved, the platform’s transparency and user-friendly design make it a compelling choice for experienced investors. As with any investment, it’s important to do your research and understand the potential risks and rewards.